Investors, creditors, and management can use the classified balance sheet to make informed decisions. For example, investors might evaluate a company’s liquidity position before deciding to invest, while creditors might assess the organization’s financial strength before extending credit. A classified balance sheet differs from an unclassified balance sheet by organizing items into categories, and providing more detailed financial information. Current liabilities include all debts that will become due in the current period. In other words, this is the amount of principle that Law Firm Accounts Receivable Management is required to be repaid in the next 12 months.

How helpful is the Classified Balance Sheet format?

In that case, the time is saved in ratio analysis due to accurate and precise classifications. However, it is mandatory to prepare and disclose the financial statements for public limited companies. The three main types of assets what is a classified balance sheet on a balance sheet are current assets, fixed assets, and intangible assets. A well-represented and well-classified information instills confidence and trust in the creditors and investors. It conveys a strong message to the investors that their money is safe as management is serious about the business’s profitability and running it ethically and within the rules of the land.

What Information Is Needed For a Business Valuation?

Here’s contribution margin what you need to know about a classified balance sheet, including how it differs from a balance sheet, its pros and cons, and what formula to use. If a company has surplus cash available and it sees a valuable investment opportunity in some other business, it can decide to buy a stake in it. In general, buyers interested in your business will also want to see the last three years of financials, so it’s important to understand how to prepare them before listing your business.

Unclassified Balance Sheet

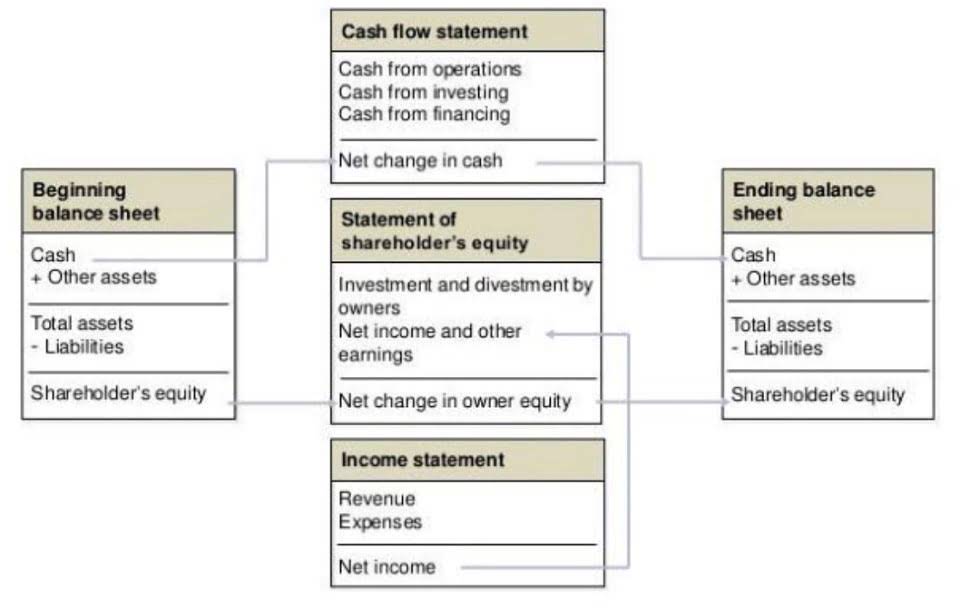

- It presents the company’s total asset base, balanced against total liabilities and shareholders’ equity.

- In any case, in a classified balance sheet format, such a computation would be direct as the administration has clearly mentioned its current assets and liabilities.

- The board can decide on what kinds of subcategories to use, yet the most recognized happen to be long-term and current.

- By following these steps, a business can prepare a classified balance sheet that provides a clear and organized snapshot of its financial position at a particular point in time.

- An unclassified balance sheet could be beneficial when only a high-level overview of the balance sheet is necessary.

- The loan terms and rates presented are from the listed providers and not by SoFi Lending Corp.

Let us understand the concept of sample classified balance sheet with the help of some suitable examples. Understanding the method of preparation of this kind of balance sheet is important. We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations in the climate space, such as Project Drawdown and the International Energy Agency (IEA).

- Plus, you could potentially need one if you ever apply for small business financing.

- The details provided in a classified balance sheet can also make it easier for owners, investors, and creditors to calculate key financial ratios.

- Users can analyze how the company’s financial position has evolved and changed from one period to another, making it easier to spot trends or potential financial issues.

- These detailed balance sheets can be prepared in both formats of reporting, either IFRS or GAAP US.

However, when it comes to making in-depth assessments and analyses, a standard (or let’s call it traditional) balance sheet is sometimes not enough. The main advantage to a classified balance sheet is that it provides more information and insight into your business’s financial health. It also makes it easy to calculate ratios that can provide further insights into how your company is doing. Plus, if you are looking to use an investor or get different types of small business loans, you may need (or want) to provide them with a classified balance sheet.